U.S. Government Fails to Act on JP Morgan Whistleblower's Evidence

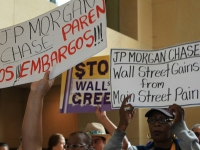

A whistleblower has stepped forward to provide evidence that executives at JP Morgan, a major Wall Street bank, were aware that the bank was selling bad mortgages - but she says that the U.S. government has failed to do anything with the evidence that she has provided to them.

Alayne Fleischmann, a former JP Morgan Chase securities lawyer, told her story to Matt Taibbi of Rolling Stone magazine, after spending six years of keeping quiet to respect a non-disclosure agreement that she signed.

Fleischmann says that as far back as 2006 when she personally warned her superiors about the problems, she was told not to put any concerns in email. Then she was asked to evaluate a $900 million packet of home loans from a mortgage originator named GreenPoint. She conducted a random sample of loans that showed that 40 percent of the borrowers had overstated their income, even though the bank had a rule that maximum acceptable level was five percent.

The bank ignored Fleischmann's warnings about the GreenPoint loans and reworked the numbers to allow them to accept the loan package. Then, two years after she was hired, Fleischmann was laid off.

Later JP Morgan would claim that it was unaware of the problems in the mortgage industry until the very last moment when the market crashed. "We concluded that underwriting standards were deteriorating across the industry." Dimon told Fortune magazine. He says he told his staff: "We need to sell a lot of our positions. . . . This stuff could go up in smoke!"

In 2012 Fleischmann agreed to testify to the U.S. Securities & Exchange Commission (SEC), the agency responsible for regulating the industry, about how JP Morgan had always known about the problems. But to her astonishment, the government did not do anything with the information.

Instead Eric Holder, the U.S. attorney general, cut a deal in late 2013 with Jamie Dimon, the CEO of JP Morgan, to have the Wall Street bank pay a $9 billion fine in return for dropping the investigation.

"Holder made a speech talking about too big to jail. He said - we don't know if it's criminal, we don't have enough evidence," Fleischmann later told Corporate Crime Reporter. "I know they have a pile of evidence and they have had it - I had been talking to the government for over two and a half years. At that point, I just stopped believing that they were going to move forward."

Fleischmann says that the government imposed fine did not match the crime. "It was like watching an old lady get mugged on the street," Fleischmann told Rolling Stone magazine. It was this betrayal that made her decide to go to the media despite the possible consequences. "I could be sued into bankruptcy. I could lose my license to practice law. I could lose everything. But if we don't start speaking up, then this really is all we're going to get: the biggest financial cover-up in history," she added.

Nor was JP Morgan the only bank that the Obama administration failed to prosecute. "I saw other cases like the HSBC case, which was an incredible money laundering case. And it looked like they (the Department of Justice or DOJ) had evidence against individuals. And yet they just settled it for money," Fleischmann added. "We see this again and again. At some stage I felt like - even if they have a strong case, you can't expect they will go forward against individuals. It will be one of these fines. And all the facts will be wiped away."

The Obama administration has continued this practice of extracting large fines in return for executive immunity. For example, this past August, Bank of America agreed to pay the government $9.65 billion to settle charges of misleading investors over mortgage lending in the run up to the 2008 financial crisis.

Legal observers say that this new system of "non prosecution agreement" deals with executives is deeply problematic.

"Yet again we have seen an inability, or a reluctance, to name and go after the individuals responsible," John Coffee, a Columbia University law professor, told the Guardian newspaper in response to the Bank of America deal.

"DOJ has championed an alternative reality that has become problematic: it sends the message that justice can be bought," Mike Koehler, Southern Illinois law professor, told a Corporate Crime Reporter conference.

"The kid-gloves approach that the DOJ and the SEC take with Wall Street is as inexplicable as it is indefensible," Dennis Kelleher of Better Markets, a non profit which campaigns to reform financial markets, told Rolling Stone. "They typically charge only one offense when there are dozens. It would be like charging a serial murderer with a single assault and giving them probation."

"Can you imagine the outcry if [former Republican era Attorney General] Alberto Gonzales had gone into the backroom and given Halliburton immunity in exchange for a billion dollars?" Kelleher added.

- 185 Corruption